In an attempt to secure funding for critical sectors such as education and avoid a possible teacher strike, the government is urgently ending plans to reintroduce the contentious eco-levy tax as part of its new revenue growth efforts.

These measures are intended to close a deficit of Ksh 150 billion caused by the withdrawal of the Finance Bill 2024. The Tax Amendment Bill, which includes 47 clauses, is being finalized for reintroduction in Parliament.

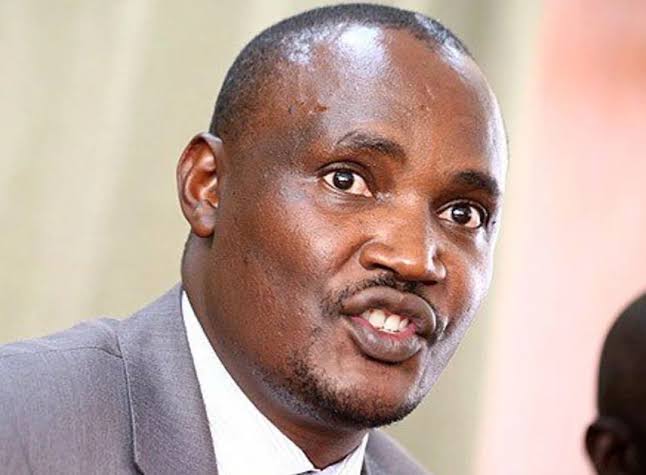

Treasury Secretary (CS) John Mbadi revealed in an interview with Citizen TV that the eco-tax, a major point of contention, will be included in the new proposals. However, he confirmed that “sensitive” items such as sanitary towels would be exempt from the tax. “We are planning 47 amendments, including the eco-levy. However, we will lift the ban on sanitary pads and other sensitive items,” he said.

This regulation is a response to the public reaction and protest led by Generation Z, which initially led to the rejection of the bill.

In addition, the eco-levy faced strong opposition from multinationals, including Coca-Cola, which opposed the proposed 10% excise tax.

*Extension of tax amnesty and new tax exemptions*

To increase revenue, the government is also extending the six-month tax amnesty period, allowing more Kenyans to file their returns without penalty. CS Mbadi expressed optimism that the extension would encourage higher compliance as some people had previously avoided paying their taxes due to tight deadlines.

In addition, the government plans to exempt certain basic products, such as bread, from taxes.

The measure is expected to save Ksh 70 billion by reducing public expenditure on tax refunds, some of which were found to be bogus. The chairman of the finance committee of the National Assembly, Kimani Kuria, said they are waiting for proposals from the Treasury to start discussions.

In addition to the eco-levy tax, CS Mbadi announced the upcoming changes in the Kenya Revenue Authority (KRA). These changes, which aim to automate systems and close loopholes, are expected to bring in an additional Ksh 105 billion.

*Emergency and budget adjustments*

The ministry is working against time to implement these fiscal measures before September 30.

These new measures are essential to close the financial deficits left by the failure of the Finance Bill 2024.

President William Ruto has already announced a Ksh 177 billion spending cut and an additional Ksh 169 billion loan to manage the deficit. The government argues that these new tax measures will be crucial for the financing of essential services. The extra income is expected to be used to pay teachers who have threatened to strike, as well as to cover the costs of security forces and university funding.

This comprehensive strategy aims to stabilize the country’s finances while meeting the urgent needs of the public sector.